1800 267 2677

Schedule a demo

SELF-PACED LEARNING COURSES

Self Learning Courses

TG Campus® offers online courses, designed by our experts to ensure high-quality education. Each course is crafted to help students learn, practice, and excel through our comprehensive content and extensive question bank.

Read More →

Online Coaching

TG Campus® provide top notch one-to-one personalized online coaching for students across various subjects. Learn with elite tutors who offer personal attention and individualized education tailored to your unique needs.

Read More →

Test Series

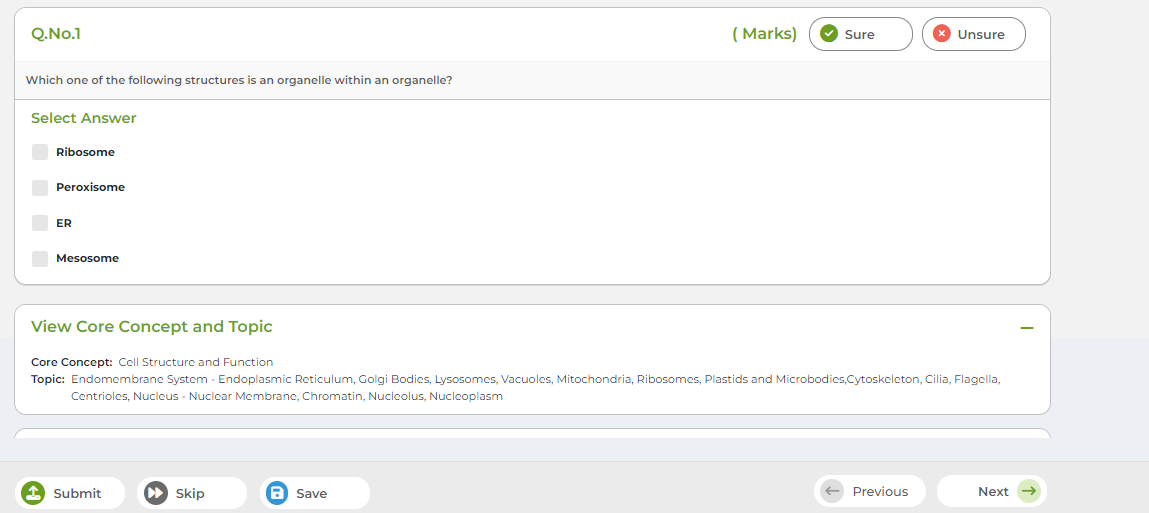

TG Campus® test series provides a comprehensive set of mock tests designed to assess your knowledge and readiness. With a wide range of questions and detailed explanations, you'll gain valuable insights to improve your test-taking skills.

Read More →LEARN, PRACTISE AND EXCEL with TG Campus®

The concepts of learn, practice, and excel often go hand in hand in the process of mastering a subject. Each stage builds on the previous one, and they are interconnected in helping you become proficient and successful in your endeavours.

TG Campus® key components

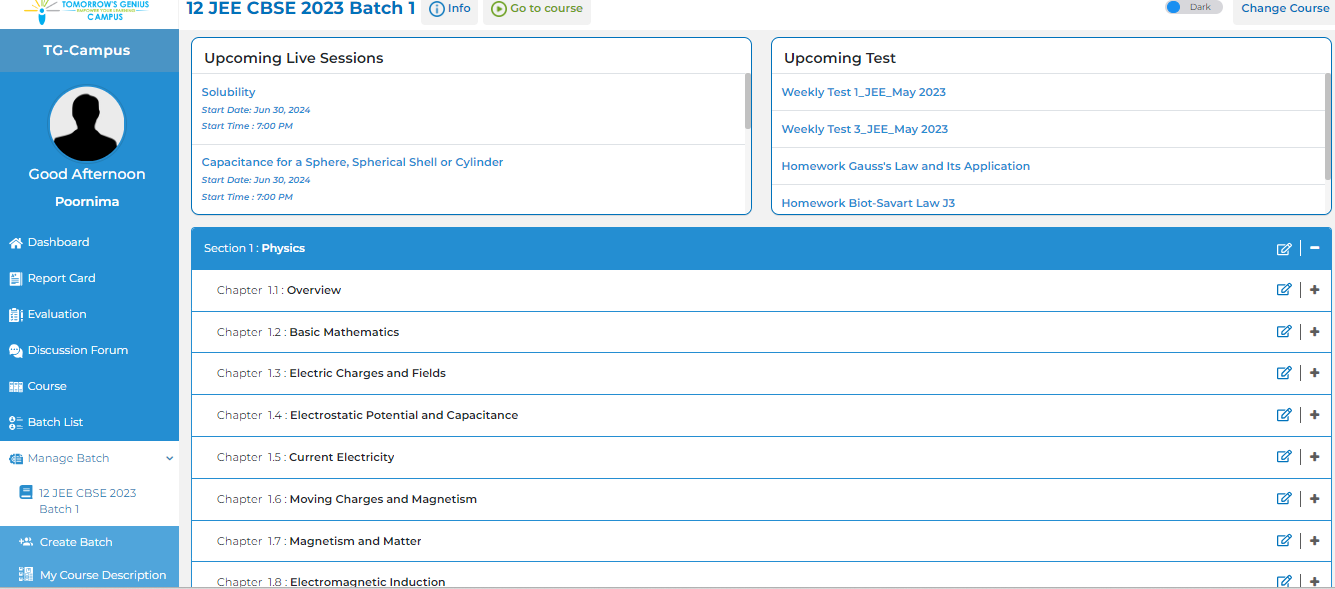

State-of-the-art cloud based platform, with over 100 man-years of development, integrating scalable learning technology and content delivery systems that leverages live online tutoring, comprehensive content, and advanced assessments.

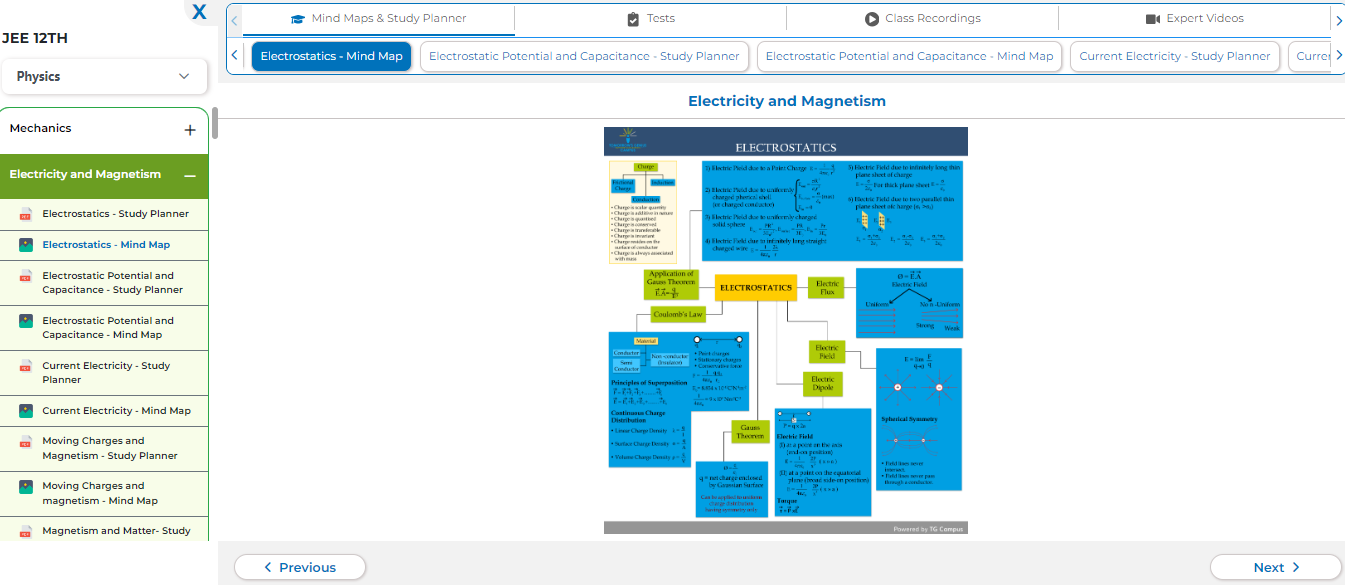

Self-Learning is for those who want to learn online without the help of teacher(s) / Instructor(s) which helps learning at own pace.

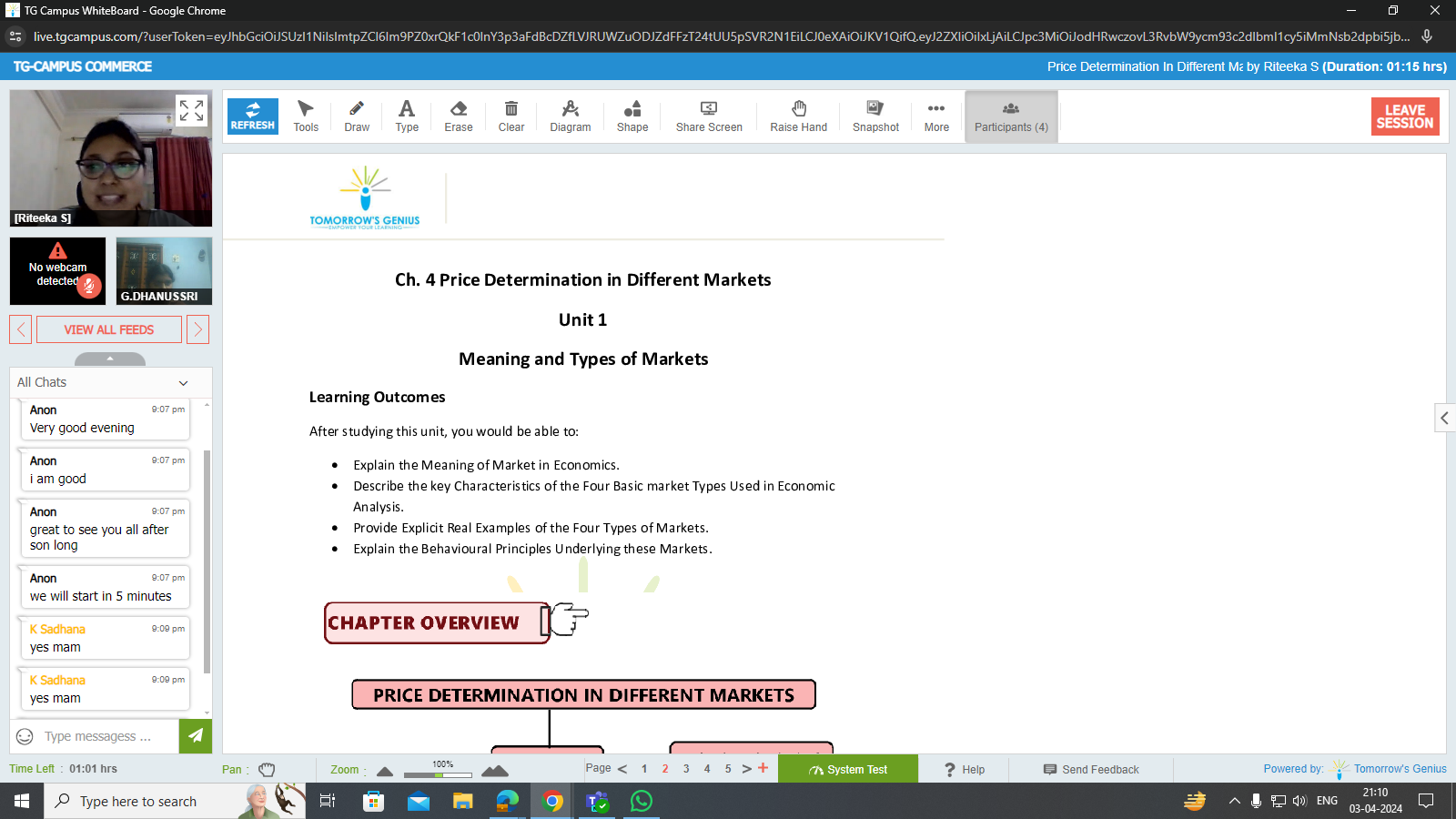

At TG Campus students can enroll and learn online. Learn with Elite Tutors with personal attention and individualized education.

Test series helps students in practicing concepts and learning strategic approaches.

Tomorrow's Genius LMS is designed to manage and deliver educational content, monitor student progress, facilitate communication between student and tutors.

Testimonials

“

Awards and recognition

TG Campus® recognized as one of the 10 Best EdTech Startups in India - 2019

TG Campus® is proud to have been recognized as "Top 10 Best EdTech Startup in India - 2019" by SiliconIndia. Our commitment is to develop advanced online learning solutions for Institutes, Schools, Tutors & students and our team is continuously working to improve the way of online education in India.

Click here to view recognition certificate by SiliconIndia

Click here to see Our Directors thoughts, featured in SiliconIndia magazine

Get A Free Demo Scheduled!

Call on Toll Free No: 1800 267 2677 and schedule a free demo.